LEARNING THE VALUE OF A DOLLAR: Today is Tax Day and April is Financial Literacy Month, which is a perfect opportunity to prioritize building the skills needed to navigate different financial situations. Helping kids develop a strong foundation in budgeting, saving, and investing sets them up for a lifetime of financial confidence and success. In recognition of Financial Literacy Month, below is a helpful guide for parents who are looking to teach themselves and their kids financial fluency.

Notable gaps in financial literacy are contributing to rampant issues across the country – from record credit card debt to low savings goals. In fact, three out of four teenagers admit they don’t understand basic financial concepts. Half can’t explain what a 401(k) is, and more than one in four can’t tell the difference between a credit card and a debit card. Make no mistake, financial literacy programs are crucial and can be integrated into virtually every grade level, from elementary and middle school to high school and college. The problem is many schools do not incorporate or require classes that teach these practical skills.

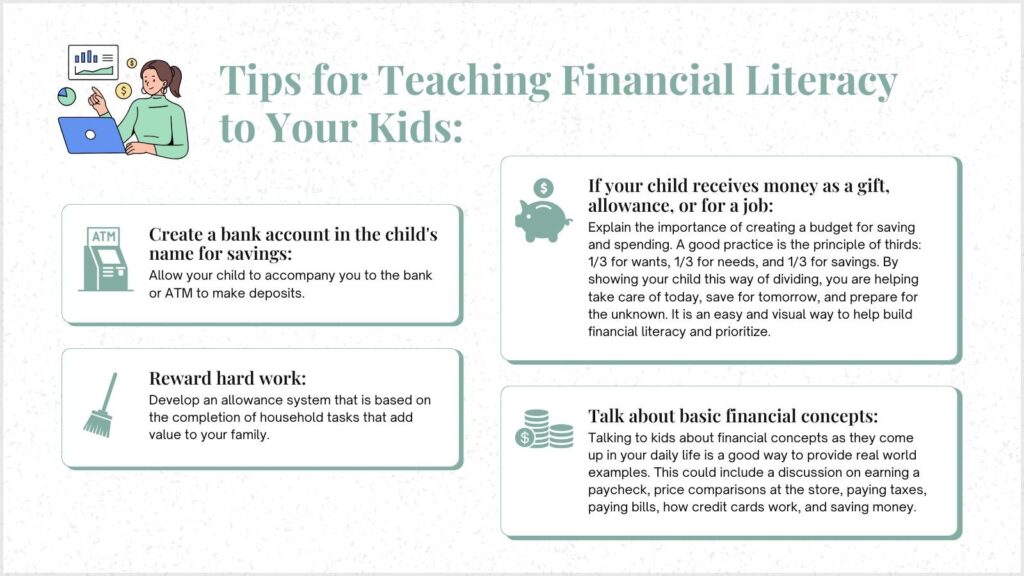

Parents can’t afford to watch from the sidelines, which means we must instead step up our own efforts to build healthy financial habits in our children. Some studies have shown that kids who grow up with good money habits are more likely to become financially independent, make smarter decisions with regard to debt and income, and be prepared for unforeseen emergencies.

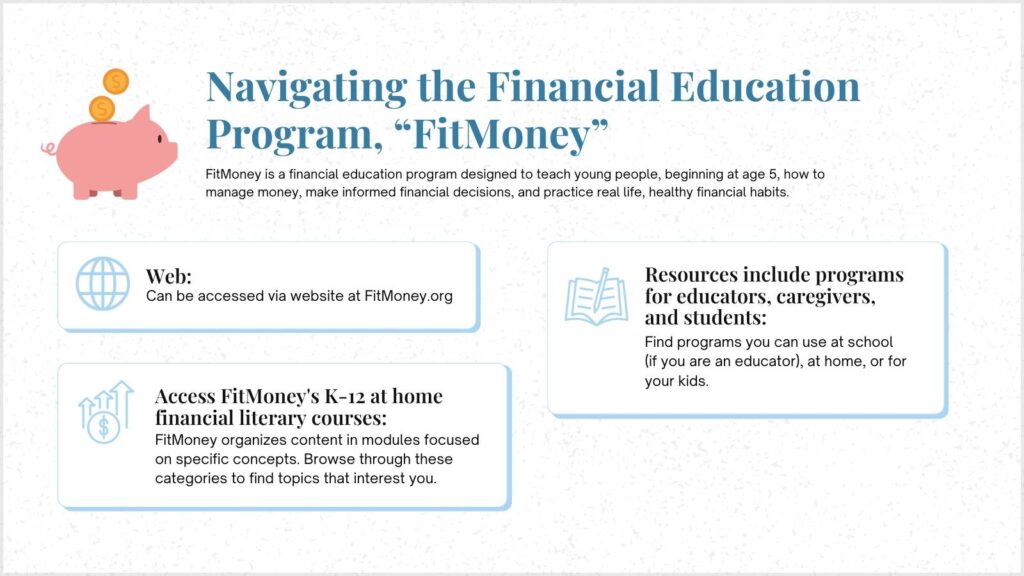

FINANCIAL LITERACY COURSES IN SCHOOLS: In addition to modeling healthy money habits at home, having a formal financial literacy program in classrooms could ensure all students can learn basic money principles regardless of economic knowledge or status.

According to one 2020 study, individuals who take financial literacy courses have fewer loan defaults and higher credit scores. Unfortunately, only half of states currently require high school students to be educated in personal finance, and of these states, only 11 currently require the class to be a separate course.

Simple changes at home and additional courses in school can prepare children to navigate real life situations like saving, credit, interest rates, investing and risk assessments.

CRYPTO MARKET: Not only should schools across our country up their financial literacy game, but they should ensure cryptocurrency–a rapidly emerging element of the global financial landscape–is integrated into such programs.

Despite being more accessible than ever, many Americans continue to feel lost when it comes to crypto and how it works. Yet, the idea of decentralized, blockchain-based assets and digital wallets is attracting young people. Recent data shows more than 57 percent of crypto owners are under the age of 35. While a youthful market can be exciting, we as parents need to ensure we are educating our kids about cryptocurrency so they can navigate this new financial realm safely and confidently.

Crypto undoubtedly has a place in the future of finance, but it remains largely unregulated, which creates significant risks for young and inexperienced investors. There is an increasing push for state-focused solutions to cryptocurrency oversight aimed at protecting Americans from scams and holding crypto criminals accountable. We need to ensure kids have the proper knowledge about financial literacy and how to protect their investments long-term. Teaching children about money should be a lifelong lesson.

TIPS FOR PARENTS

OTHER NEWS YOU NEED TO KNOW

BALTIMORE SCHOOL LAUNCHES FINANCIAL LITERACY PROGRAM FOR KIDS: In celebration of financial literacy month, a Baltimore school launched a campaign called “Littler Learners, Big Earners,” to teach young children the foundation of financial literacy and how to develop smart habits in a fun, age-appropriate way. Read more here.

THE DEPARTMENT OF EDUCATION BEGINS ‘SPECIAL INVESTIGATIONS TEAM’ TO ROOT OUT RADICAL GENDER IDEOLOGY: Amid President Trump’s executive orders, The Department of Education declared a Title IX “Special Investigations Team” (SIT) to address issues relating to school gender ideology programs, including biological males competing in female sports. Read more here.

TENNIS LEGEND CALLS OUT UNFAIR PUNISHMENT OF FEMALE FENCER: Tennis champion Martina Navratilova is calling out the decision to disqualify female fencer Stephanie Turner after she refused to compete against a biological male. Navratilova called the punishment “outrageous” and said this “should not happen,” backing Turner’s stand for fairness in women’s sports. Read more here.

GEORGIA PROTECTS WOMEN’S SPORTS WITH ‘RILEY GAINES ACT’: Georgia lawmakers passed the “Riley Gaines Act,” taking decisive action to ensure girls’ and women’s sports are reserved for female athletes only. The law requires student-athletes to compete based on their biological sex, defending fairness and preserving opportunities for women across the state. Read more here.

Thanks for reading the latest edition of the American Parents Coalition’s The Lookout. If you have a troubling story to share about a school, doctor, company, or other institution working to usurp parents’ rights, please let us know by emailing us at [email protected].